In the realm of payroll management, the generation of pay stubs has undergone a remarkable evolution over the years. Traditionally, pay stubs were manually created, involving a labor-intensive and time-consuming process. However, with advancements in technology, the payroll industry has shifted towards automated systems, streamlining the pay stub generation process significantly. This evolution has brought about numerous benefits, including increased efficiency, accuracy, and compliance. In this article, we explore the journey of pay stub generation, highlighting the key milestones and advancements that have shaped the transition from manual to automated processes.

Manual Pay Stub Generation

In the past, businesses relied on manual methods to create a pay check stub. This involved a series of tedious tasks, such as gathering payroll data, calculating deductions, and formatting the information into a presentable pay stub. Payroll administrators had to spend hours performing these tasks, which left room for human error and often resulted in delays. Manual pay stub generation was also challenging to maintain as businesses grew, leading to inefficiencies and potential compliance issues.

The Emergence of Payroll Software

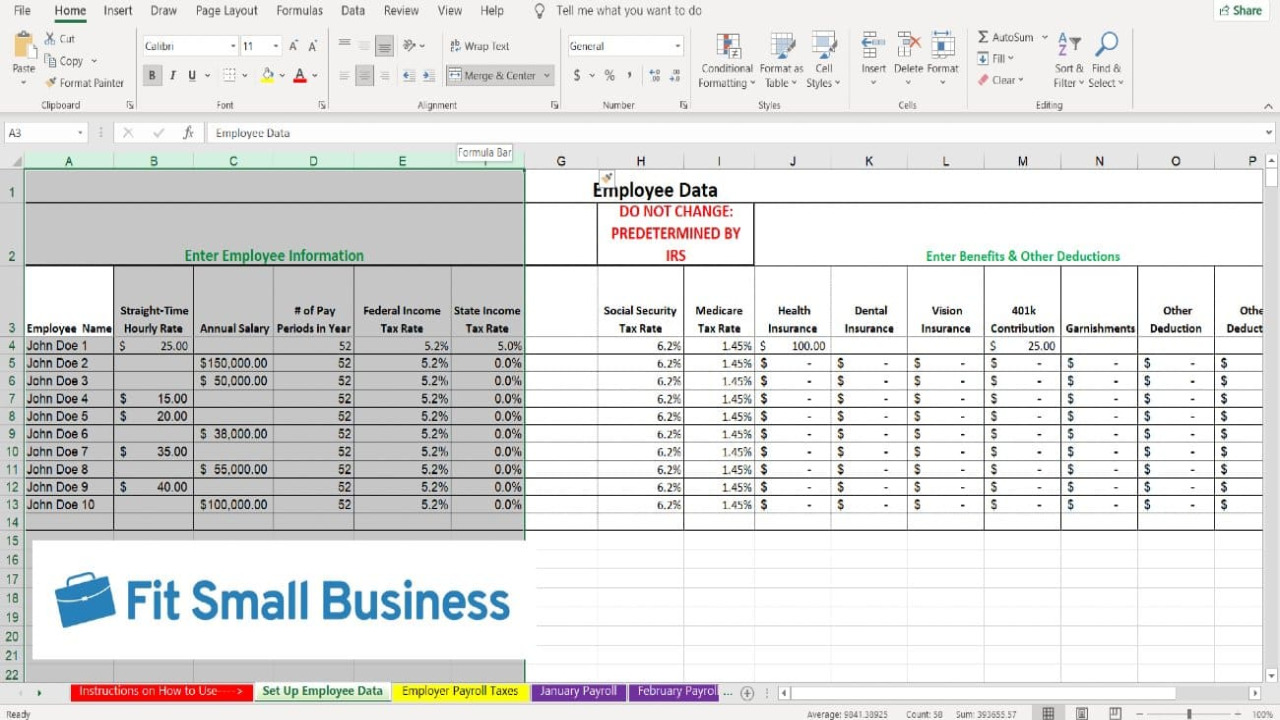

The advent of payroll software marked a significant turning point in the evolution of pay stub generation. With the development of dedicated payroll systems, businesses could automate various payroll processes, including pay stub generation. These software solutions allowed HR and payroll teams to enter employee data, earnings, deductions, and taxes into the system, which would then automatically calculate and generate individual pay stubs.

Payroll software not only reduced the time required to process payroll but also improved accuracy and compliance. The risk of errors diminished significantly as calculations were performed automatically, leaving less room for mistakes. Additionally, these systems are often integrated with time tracking, attendance, and tax withholding modules, streamlining the entire payroll process. As a result, businesses saw increased efficiency and enhanced employee satisfaction due to timely and error-free pay stubs.

Transition to Cloud-based Payroll Systems

In recent years, cloud technology has revolutionized the way businesses manage their operations, and payroll is no exception. Cloud-based payroll systems took the automation of pay stub generation to new heights by providing unparalleled accessibility, security, and scalability. Businesses no longer needed to invest in expensive infrastructure to host their payroll data and software. Instead, they could access payroll platforms through secure internet connections from anywhere in the world.

Cloud-based payroll systems also paved the way for self-service portals, enabling employees to access their pay stubs online at any time. This self-service functionality empowered employees, reducing the burden on HR and payroll administrators for reprinting or distributing physical copies. Moreover, these systems could easily adapt to changing regulations and tax laws, ensuring compliance and eliminating the need for manual updates.

Conclusion

The evolution of pay stub generation from manual to automated processes has undoubtedly transformed the payroll landscape. The arduous and error-prone manual methods have given way to streamlined, efficient, and accurate automated systems. Payroll software and cloud-based platforms have revolutionized how businesses manage payroll, allowing them to focus more on strategic initiatives and less on administrative tasks.

As technology continues to advance, we can expect further innovations in pay stub generation, such as artificial intelligence-powered analytics, enhanced security measures, and seamless integration with other HR and accounting tools. The journey from manual to automated pay stub generation demonstrates how embracing technology can bring about positive changes in organizational efficiency, compliance, and employee satisfaction.